As a business owner, understanding the differences between accountants and bookkeepers is crucial for making informed decisions about your financial management. Whether you're searching for accounting and bookkeeping services near or trying to figure out which professional you need, knowing their distinct roles is essential. Both roles are essential, but they serve different purposes. In this article, we'll explore the responsibilities, qualifications, costs, and how to choose the right service for your business needs.

Accountants play a vital role in your business by preparing financial statements, conducting audits, filing taxes, and providing strategic financial advice. They ensure compliance with laws and regulations, helping you navigate the complexities of financial management. Accountants often hold certifications such as CPA (Certified Public Accountant), which signifies their expertise and commitment to professional standards.

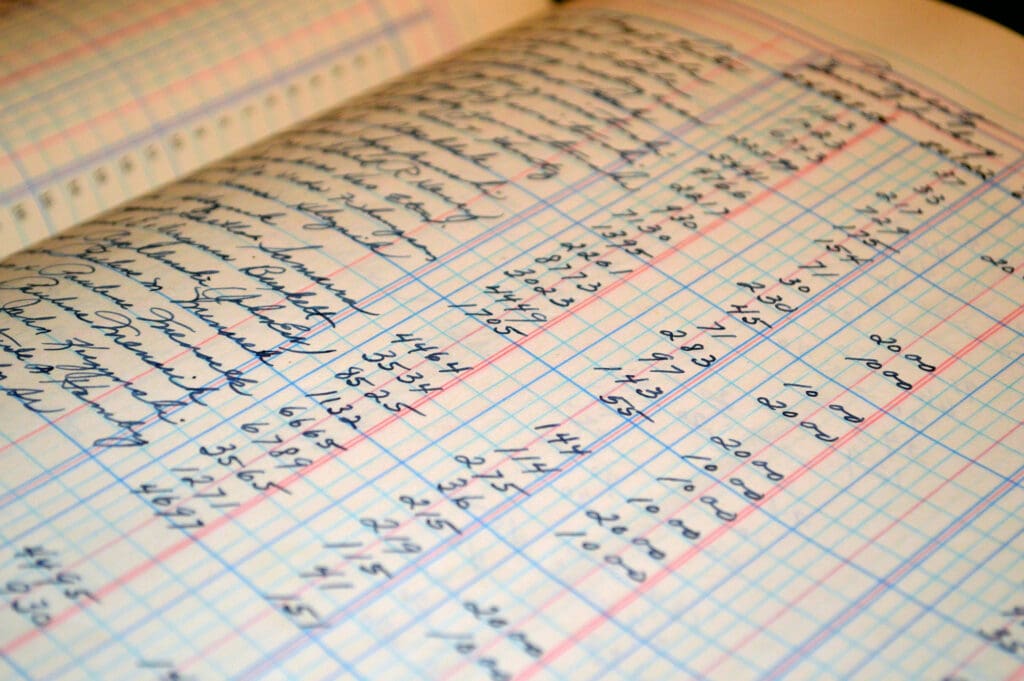

Bookkeepers manage the daily financial transactions of your business. They record transactions, manage accounts payable and receivable, and maintain accurate ledgers. While their role is more administrative, ensuring that records are accurate and up-to-date is crucial for the smooth operation of your business. Unlike accountants, bookkeepers typically do not provide in-depth financial analysis or strategic planning.

Accountants usually hold a bachelor's degree in accounting or finance and may pursue additional certifications like CPA, CMA (Certified Management Accountant), or CFA (Chartered Financial Analyst). This advanced education and certification enable them to handle complex financial tasks and offer strategic insights.

Bookkeepers often require a high school diploma or an associate degree. Certification programs, such as those from the American Institute of Professional Bookkeepers (AIPB), can enhance their qualifications. These programs demonstrate their expertise and commitment to maintaining high standards in bookkeeping.

Due to their advanced qualifications and broader scope of services, accountants generally charge higher fees. Their services are ideal for tasks requiring detailed financial analysis, tax preparation, and strategic financial planning. Investing in an accountant can be beneficial for long-term financial health and compliance.

Bookkeepers typically charge lower fees compared to accountants. They are perfect for managing daily financial transactions, maintaining accurate records, and ensuring compliance with basic financial regulations. For small businesses or those with straightforward financial needs, bookkeepers offer a cost-effective solution.

Evaluate your business needs to determine whether you require the detailed financial analysis and advisory services of an accountant or the daily transaction management of a bookkeeper. Assess the complexity of your financial situation and the specific tasks you need help with.

Consider your budget and the complexity of your financial needs. If your business is small and primarily requires help with basic financial tasks, a bookkeeper may be sufficient. For more complex financial management and strategic planning, an accountant is the better choice.

Some businesses benefit from using both accountants and bookkeepers. Bookkeepers handle daily transactions and record-keeping, while accountants provide higher-level analysis and strategic advice. This hybrid approach ensures comprehensive financial management tailored to your business's needs.

After reading this article, we encourage you to contact Rought & Accounting for personalized advice on your specific financial needs. Visit our website or schedule a consultation to learn how our accounting and bookkeeping services near me can benefit your business.

Developing a robust accounting system is crucial for the success of any startup. Efficient accounting practices ensure accuracy, compliance, and strategic decision-making, helping your business thrive in a competitive landscape. At Rought & Accounting, we specialize in guiding startups through the maze of financial management, ensuring that your accounting systems are not just compliant but also optimized for your unique business needs.

In the fast-paced world of startups, efficiency is key. Automating repetitive accounting tasks such as expense management, bank reconciliation, payroll processing, and financial reporting can save invaluable time and reduce errors. Automation enhances the effectiveness of your accounting operations, allowing you to focus on core business activities while maintaining accurate financial records.

The digital age has made cloud-based accounting solutions a game-changer for startups. By adopting cloud storage, you minimize the reliance on paper, leading to increased productivity and significant environmental benefits. Cloud-based systems secure your data and improve accessibility, ensuring that you can manage your finances anytime, anywhere, with just a few clicks.

Selecting the right accounting software is pivotal for your startup. It should align with your business’s specific needs, offering the right features, user-friendliness, and compatibility with your operations. Instead of relying solely on free trials, which may require repeatedly setting up your books, invest time in thorough research and request demonstrations from software providers. This approach helps ensure the software not only fits your current needs but also accommodates future growth.

The world of accounting is ever-evolving, and so should your accounting system. Regular evaluations and updates are essential to keep your system efficient and compliant. Additionally, investing in training and support services ensures that your team can maximize the benefits of your accounting software, keeping your startup ahead of the curve.

At Rought & Accounting, we understand the challenges startups face in developing and improving their accounting systems. Our expertise is tailored to help you streamline your accounting processes, reduce manual errors, and make informed financial decisions. Whether you’re laying the foundation of your startup’s accounting system or looking to optimize an existing one, our team is here to guide you every step of the way.

Developing and improving your startup’s accounting system is a vital step towards securing its financial health and future success. By embracing automation, cloud-based solutions, and the right software, you can build a robust accounting framework that supports efficient operations and strategic decision-making. Remember, at Rought & Accounting, we’re more than just your accountants; we’re your partners in growth, dedicated to helping your startup navigate the complexities of financial management.

In today's fast-paced business environment, efficiency, expertise, and financial clarity are not just advantages—they are necessities. For many small to medium-sized businesses, achieving this level of financial management internally can be a challenge, often diverting valuable resources away from core business functions. This is where the benefits of outsourced accounting come into sharp focus. Rought & Accounting, with its comprehensive suite of accounting services, stands ready to guide businesses through the complexities of modern financial management, ensuring they remain competitive and financially sound.

One of the most immediate benefits of outsourced accounting is the significant cost savings it offers. For businesses considering the switch, it's essential to understand that maintaining an in-house accounting department comes with substantial overhead costs—salaries, benefits, training, and not to mention the space and technology they require. By partnering with a firm like Rought & Accounting, businesses can access a team of accounting experts without the financial burden of full-time staff. This strategic move not only reduces expenses but also converts fixed costs into variable costs, providing more flexibility in budget management.

In the realm of accounting and financial management, staying abreast of the latest technologies and regulatory changes is crucial. Outsourced accounting firms invest heavily in cutting-edge technologies and continuous staff training to serve their clients better. Rought & Accounting brings this advantage to its clients, offering access to a team of professionals who are experts in the latest financial software and regulatory standards. This ensures that financial reporting, tax planning, and decision-making are based on the most current and accurate information available, enabling better strategic planning and risk management.

By outsourcing accounting functions, business owners and their teams can reallocate their time and resources towards areas that drive growth and innovation. This shift in focus can lead to improved product development, customer service, and market expansion efforts. The peace of mind that comes from knowing that financial matters are being handled by experts cannot be overstated. It allows business leaders to concentrate on their vision for the company without being bogged down by the complexities of financial management and compliance.

As businesses grow and evolve, their financial management needs can change dramatically. Outsourced accounting services offer unparalleled scalability and flexibility, allowing businesses to adjust the level of service they receive based on current needs. Whether scaling operations up in times of growth or down during slower periods, Rought & Accounting can adapt its services accordingly, ensuring that businesses have the financial support they need at every stage of their development.

In a landscape where business agility and financial acumen are more critical than ever, the value of outsourced accounting cannot be overstated. From cost savings and access to expertise to improved operational efficiency and scalability, the benefits are clear. For businesses looking to streamline their financial operations and focus on growth, Rought & Accounting offers the expertise and support needed to navigate the complexities of modern finance.

In today's digital age, businesses face an ever-increasing threat of fraud, with sophisticated schemes designed to deceive even the most vigilant. As a business owner, staying informed and proactive is your first line of defense against these malicious activities. Rought & Accounting is here to guide you through the essential steps to fortify your business against potential fraud.

The digital landscape has broadened the horizons for businesses but has also opened the door to various cyber threats, including Business Email Compromise (BEC) scams. These scams often involve fraudsters posing as trusted individuals or spoofing email addresses to make fraudulent financial requests. With reported losses in the billions, recognizing the signs of such scams is paramount. Be wary of urgent financial requests and always verify the authenticity of the communication.

Fake check or overpayment scams are among the oldest yet still prevalent threats to businesses. In such scenarios, a scammer may overpay using a check and then request a refund through untraceable means. To counteract these and other fraudulent activities, you can adopt stringent verification processes for all transactions. Ensure checks' authenticity and be cautious with refund requests, especially if the method of refund is hard to trace. At Rought & Accounting, "positive pay" is a service used to assure banks can detect fraud. Checks are analyzed through an automated system and compare to check register date provided by the business at the time the check is written. Positive pay is an effective tool used against unauthorized or fake checks.

An informed and vigilant workforce is a formidable barrier against fraud. It's vital to train your employees to recognize and respond to potential scams. This includes understanding how to identify secure websites, protect payment details, and recognize the warning signs of a scam. Consider conducting scam simulation workshops or creating comprehensive guidebooks as part of your employee training programs.

Segregation of duties is a critical component in fraud prevention, particularly in financial management. Ensure that no single employee has control over all aspects of financial transactions. This practice not only minimizes the risk of fraudulent activities but also promotes a checks-and-balances system within your financial operations.

Rought & Accounting encourages business owners to assess their current operations critically, especially in areas vulnerable to fraud. Consider scheduling a consultation with us to discuss personalized strategies and solutions tailored to your business's unique needs. Together, we can build a robust defense system to safeguard your hard-earned assets against the evolving threat of business fraud.

Account Reconciliation: Ensuring Financial Health for Businesses

In the dynamic world of business, maintaining accurate financial records is not just a necessity; it's the cornerstone of success. As Reno's leading accounting firm, Rought & Accounting firmly believes in empowering businesses through meticulous financial management, with a special emphasis on the crucial process of account reconciliation.

The Pillar of Financial Accuracy

Accuracy in Financial Reporting: A Non-Negotiable for Business Growth

For any business, the accuracy of financial statements is paramount. It's not just about keeping numbers in check, but it's a reflection of your business's health and integrity. Account reconciliation plays a pivotal role here. It involves comparing internal financial records against external statements (like bank, investment, and loan statements) to ensure every transaction is accounted for and recorded correctly. This process, although seemingly mundane, is a critical step in ensuring that your financial statements are reliable and trustworthy.

In the realm of financial reporting, even the smallest discrepancies can lead to significant problems. Misreported figures can skew your understanding of your business's financial position, leading to misguided decisions. Regular reconciliation by a skilled Reno accountant helps keep these figures accurate, providing a true reflection of your business's financial health.

The Shield Against Financial Discrepancies

Detecting Errors and Preventing Fraud: The Unsung Heroes of Financial Management

Another critical aspect of account reconciliation is its ability to act as a first line of defense against errors and fraudulent activities. Inconsistent transactions, be they accidental or intentional, can be detrimental to a business’s financial stability. Reconciling accounts promptly helps in identifying these discrepancies early.

Imagine a scenario where an unnoticed error or a fraudulent transaction goes undetected for an extended period. The financial repercussions can be significant, not to mention the potential legal and reputational damage. By regularly reconciling accounts, businesses can swiftly identify and rectify such issues, safeguarding their financial assets.

The Blueprint for Future Success

Budgeting and Financial Planning: Navigating Towards Prosperity

Accurate account reconciliation also lays the foundation for effective budgeting and financial planning. Understanding where your business stands financially assists in making informed decisions about future investments, expenses, and growth strategies. This clarity is essential, especially in a competitive business environment like Reno.

With precise reconciliation, businesses can forecast future cash flows more accurately, allocate resources efficiently, and plan for both short-term needs and long-term goals. This forward-thinking approach is what separates thriving businesses from the rest.

The Path to Compliance and Confidence

Audit Readiness and Compliance: Staying Ahead of the Curve

Lastly, in today's heavily regulated business world, compliance with accounting standards is not optional. Regular account reconciliation ensures that your business is always prepared for audits and complies with these standards. This preparation not only minimizes the risk of penalties and legal issues but also instills confidence among investors and stakeholders about the credibility of your financial reports.

Your Partner in Financial Mastery

At Rought & Accounting, we understand the nuances and complexities of account reconciliation and its impact on your business. We are committed to providing exceptional accounting services to ensure your financial records are accurate, compliant, and audit-ready.

As your trusted Reno accountant, we invite you to explore how our expertise in account reconciliation can contribute to your business's financial success. We are here to assist you in every step of your financial journey.

Remember, in the world of business, the accuracy of your accounts isn't just about numbers; it's about the health and future of your enterprise. Let's work together to ensure that future is as bright and prosperous as possible.